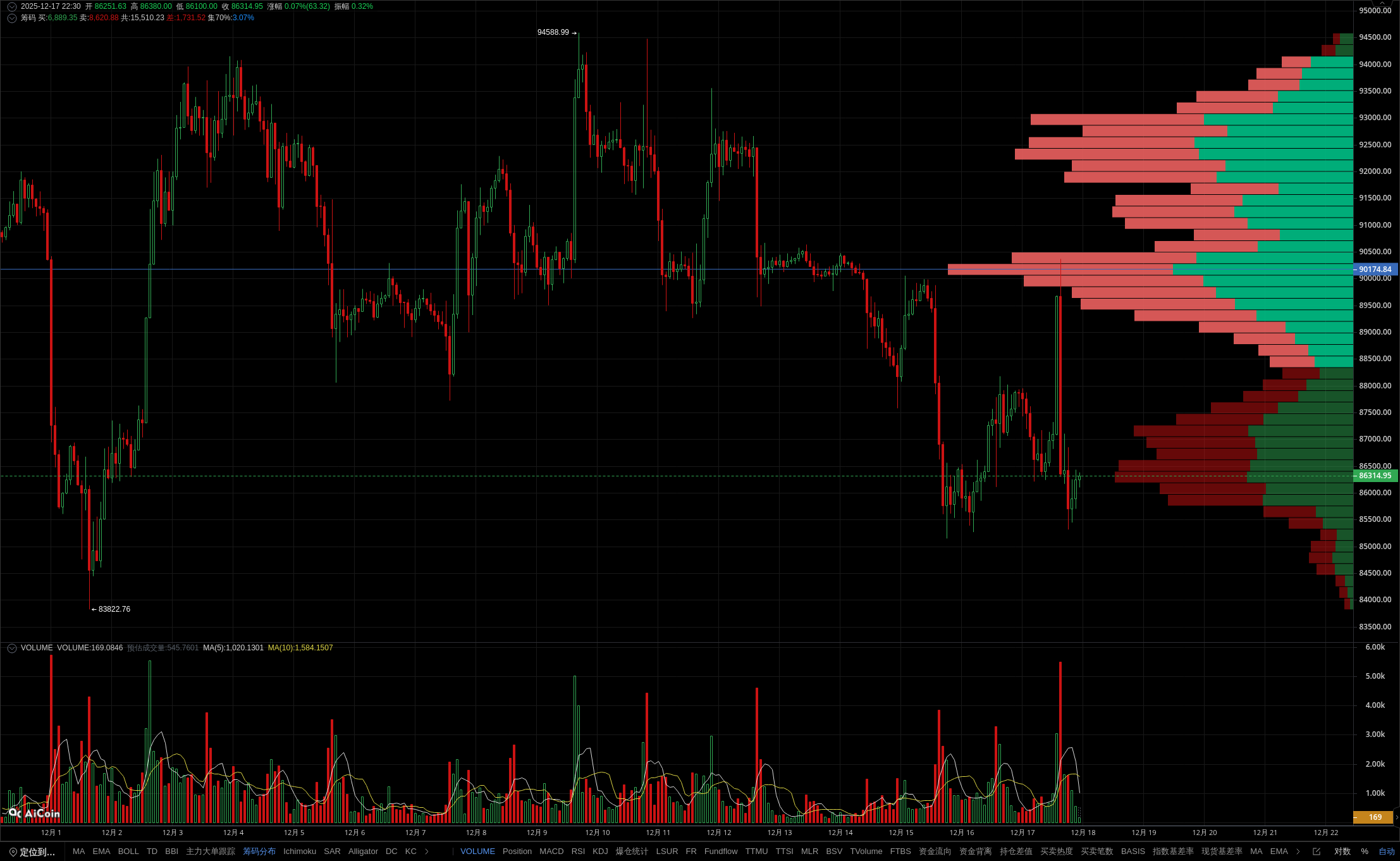

BTC 90 minute cycle: Key resistance suppression, alert to downside risks

The latest 90 minute cycle shows that the price is running below the EMA24 and EMA52 moving averages, and the member exclusive chip distribution indicator reveals a strong resistance zone near 90371. The current price attempts to break through but the volume can shrink to 32.98% of the average level, indicating insufficient upward momentum. The appearance of an upper hanging line in combination with the K-line pattern suggests that there may be short-term pressure and a pullback. Further verifying the bearish signal, MACD is at a dead cross below the zero axis, and coupled with RSI being in oversold territory, the market has limited room for rebound. If it falls below the 86100 support, it may accelerate its downward trend to the 85300 area. Open a membership, obtain precise resistance support levels, and lock in trading opportunities in advance! The data is sourced from the PRO member's [BTC/USDT Binance 90 minute] candlestick, for reference only, and does not constitute any investment advice.