Loading...

--

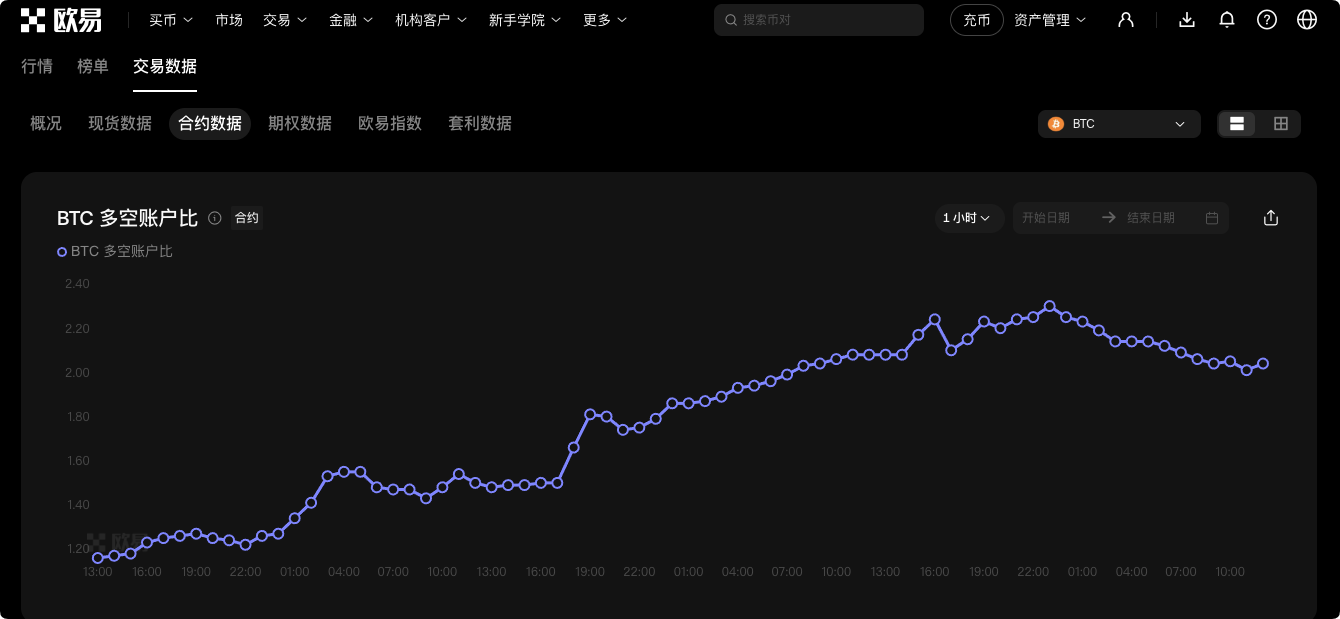

As of around 14:00 on January 9, 2026, the long short account ratio (number of long accounts/number of short accounts) of BTC contracts on the OKX platform has fallen back to about 2.04, and gradually fluctuated downwards after approaching the high point of 2.20 in the morning. However, the overall level remains above 2.0, and the number of accounts holding long positions continues to be significantly higher than short positions. Although the bullish sentiment of retail investors has slightly cooled down, it is still in a relatively strong range. Mainstream interpretation: The current BTC price is fluctuating narrowly around $90000- $92000, and the long short account ratio has slightly fallen from yesterday's high point, indicating that some retail investors are taking profits or adopting a wait-and-see attitude, but the ratio still remains above 2.0, indicating that the proportion of long sellers is still relatively high. As a typical indicator of reverse sentiment, a high-level pullback can be seen as a mild release of short-term overheated emotions, which helps alleviate the risk of liquidation, short-term selling pressure or marginal weakening, and alleviate the pressure above. The medium-term trend remains optimistic, with limited room for correction. It is recommended that investors maintain a bullish mindset and use a slight correction to gradually increase their positions in spot or light positions. They should pay attention to controlling their positions, monitoring whether the long short ratio continues to fall below the support zone of 1.8-1.9, and coordinating with trading volume to avoid excessive pursuit of long positions when the ratio rises again. Register OKX now and receive a permanent 20% refund Company Registered Address https://jump.do/zh-Hans/xlink?checkProxy=true&proxyId=2 Risk statement The content of this article represents the author's personal views only and does not represent the position of this platform. The views, conclusions, and recommendations in the article are for investors' reference only and do not constitute any investment advice related to this platform. The market is risky, and investment needs to be cautious.