24/7 Flashes

More >Today 2025-11-15

00:30

Yala稳定币YU现高风险信号,相关地址高利率借款未还

[Yala Stablecoin YU Shows High-Risk Signal, Related Address Fails to Repay High-Interest Loans] The DeFi community YAM posted on Platform X, stating that the Yala stablecoin YU has shown warning signs. An address closely associated with Yala has fully borrowed USDC and most of the YU funds from the Yala Frontier market on Euler. Despite persistently high interest rates, the loans remain unpaid, causing the market's fund utilization rate to reach 100%, leaving lenders unable to withdraw liquidity. The Euler team has set the borrowing cap for this market to zero. The Yala team has yet to respond to the Euler team or Discord community users. YAM noted that the peg rate on YAmericaolana remains stable, with nearly one million USDC in the liquidity pool available for withdrawal at the pegged price. This post serves as a risk warning, and it is not yet confirmed whether Yala is in distress.

00:25

Unknown Whale: Closing 25 times leverage ETH long position, losing $2.76 million

Monitoring shows that the unknown whale has completely closed its 25 times leveraged ETH long position in its wallet, losing $2.76 million and withdrawing funds from HyperLiquid. At present, the main wallet of the whale still holds BTC and ETH, with a floating loss of 2.87 million US dollars. (Onchain Lens)

00:18

长期持有者日抛 4.5 万枚 ETH,以太坊接近 3,000 美元支撑位

[Long-term holders sell 45,000 ETH daily, Ethereum approaches $3,000 support level] According to Glassnode data, long-term Ethereum addresses holding for more than 155 days are currently selling approximately 45,000 ETH daily, valued at around $140 million. This selling volume is the highest level since February 2021. Technical analysis indicates that if Ethereum's price falls below the critical $3,000 support level, it could trigger further corrections to around $2,500 or lower.

00:00

AiCoin Daily (November 15th)

1. Federal Reserve's Schmid: Lowering Reserve Rate to Alleviate Liquidity Pressure 2. The People's Bank of China will carry out a reverse repurchase operation worth 800 billion yuan 3. After the US government reopened, the market sold off and gold prices fell 4. Guggenheim Chief Investment Officer: Economic slowdown may prompt Federal Reserve to cut interest rates in December 5. Alibaba collaborates with JPMorgan Chase to launch a tokenized payment system 6. US stock sell-off intensifies, with the S&P 500 index falling more than 1% three times in eight days 7. US Department of Justice Recovers $15 Million in Cryptocurrency from North Korea's Illegal Financial Activities The above is a selection of hot topics from the past 24 hours. Click to see the full article: https://www.aicoin.com/article/500530

News.yestory 2025-11-14

23:54

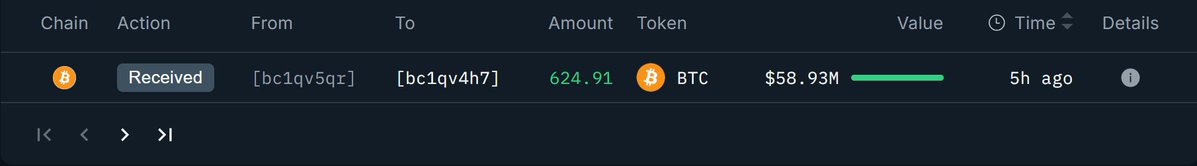

Newly created wallet receives 624.9 BTC worth approximately $58.93 million

Monitoring shows that a newly created wallet received 624.9 BTC worth approximately $58.93 million from BitGo, with an address of bc1qv4h7k0z53qq2f209dd45amuf7jrsrdqrp95pu6uzg84ewvjp7meqcyk3eu。 The funds flowed into the new wallet from BitGo, but the specific purpose is not yet clear. (Onchain Lens)